Tronc Master Friendly

Tronc Master can easily upload, calculate, and manage tips

Use our Tronc NIC Savings Calculator below to estimate your potential savings:

| Employer NI | Employee NI | Total Savings | |

|---|---|---|---|

| Monthly Savings | £0.00 | £0.00 | £0.00 |

| Annual Savings | £0.00 | £0.00 | £0.00 |

Using our Tronc Payroll system provides significant National Insurance (NI) savings by exempting employers from NI contributions on tips distributed through an independent troncmaster, all while ensuring full HMRC compliance. Employees also benefit from NI savings, increasing their take-home pay. This makes the Tronc system a cost-effective and fair solution for tip management.

Handling tips and service charges in the hospitality industry can be complex, requiring fair employee distribution and strict compliance with tax rules. Tronc Payroll provides a specialised system to efficiently manage these tasks, ensuring fairness and regulatory adherence with ease.

Implementing a Tronc Payroll system is a strategic choice for hospitality businesses, delivering substantial savings on employer National Insurance contributions while boosting employee morale. By streamlining tip distribution and simplifying compliance, it frees employers to concentrate on delivering exceptional customer experiences instead of managing time-consuming administrative duties.

Tronc Master can easily upload, calculate, and manage tips

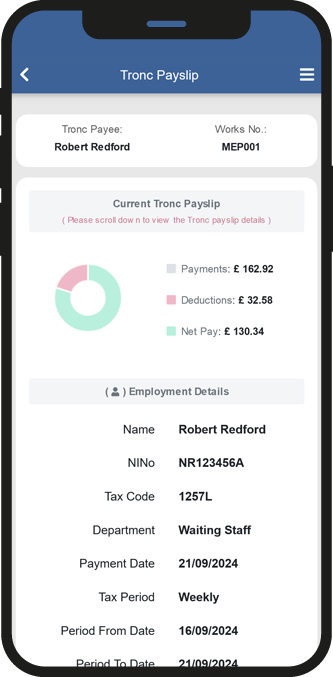

Deliver tronc and tip payslips directly to employees.

Enables Employer (13.8%) & Employee (upto 12%) NIC savings

Built for mobile users with seamless desktop integration.

Our Tronc Payroll is Free to Use for all Business Establishments

Fully HMRC-Compliant Tronc Payroll Solution

Tronc Payroll is provided and operated by HMRC Recognised "1 A Simple Payroll" system. Tronc Payroll is part of "1 A Simple Payroll" System which is officially recognised by HM Revenue & Customs (HMRC) for Pay As You Earn (PAYE) ensures that your tronc payroll is always compliant with UK tax regulations.

With our built-in RTI payroll system, we submit returns directly to HMRC, keeping your business compliant with payroll laws. While Version 1 focuses on an API-driven payroll engine without reports, it guarantees accurate and timely submissions.

Whether you're an employer or a troncmaster, Tronc Payroll simplifies the management of tips while keeping everything above board with HMRC.